Personal Loan Review for Salary Earners

For working Malaysians earning RM2,000 and above. Submit payslip & IC for professional review.

- Approval Assessment

- 3 Months Payslip Required

- KL & Selangor Only

- KL & Selangor Only

- 3 Months Payslip Required

- Approval Assessment

ABOUT US

Apply KL Loan provides professional personal loan review services for salary earners in Malaysia.

We focus on clear assessment, honest explanation, and responsible lending. Each case is reviewed based on income stability, not just credit records. Applicants with CTOS, AKPK, or past financial issues may still be considered, subject to evaluation.

Our process includes face-to-face appointments to ensure accurate verification and transparent discussion of approval chances, interest rates, and repayment structure.

Apply KL Loan, there is no pressure to proceed. We believe applicants should fully understand their options before making a decision.

WHO IS THIS FOR

This loan review is for working Malaysians with stable salary income.

- You can apply if you:

- Are a Malaysian citizen

- Earn RM2,000 or above monthly

- Are full-time employed (Permanent or Contract)

- Can attend a face-to-face appointment

- Can provide:

- Latest 3 months payslip

- Malaysia IC (front only)

Applicants with CTOS or weak credit history may still be reviewed, subject to assessment.

- This is NOT suitable if you:

- Are self-employed

- Are a freelancer or commission-based

- Cannot provide payslip

- Are non-Malaysian

We prioritise income stability, not informal or irregular income.

DOCUMENTS REQUIRED

🔒 All information is handled confidentially.

01

Latest 3 months payslip

02

Malaysia IC (front only)

03

Basic contact & employment details

WHY CHOOSE US

Blacklist Accepted

CTOS / AKPK / Bankruptcy cases can be reviewed

Fast Review Process

Assessment completed within 24–48 hours (subject to case)

Flexible Repayment

Tenure from 6 months up to 5 years

Transparent & Simple

No hidden fees. Payslip, IC, basic details only

Blacklist Accepted

CTOS / AKPK / Bankruptcy cases can be reviewed

Fast Review Process

Assessment completed within 24–48 hours (subject to case)

Flexible Repayment

Tenure from 6 months up to 5 years

Transparent & Simple

No hidden fees. Payslip, IC, basic details only

HOW THE PROCESS WORKS

Step 1

Submit your details through the form

Step 2

Our consultant reviews your salary & credit condition

Step 3

You will be contacted for a face-to-face appointment to:

- Understand approval chances

- Review interest & repayment structure

- Decide if this loan suits you

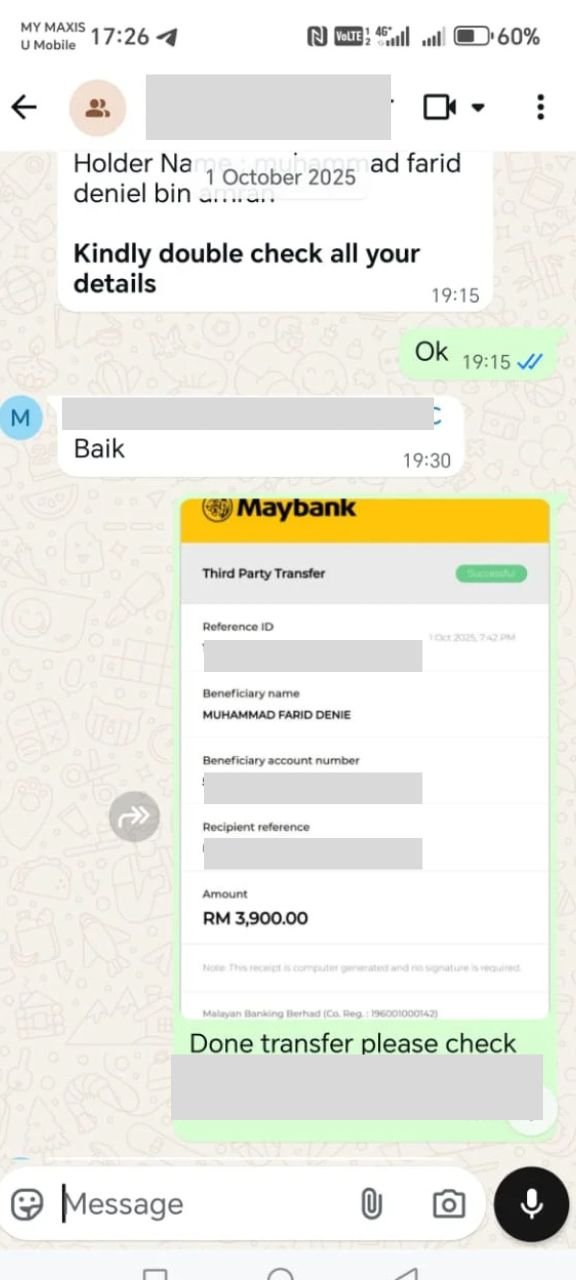

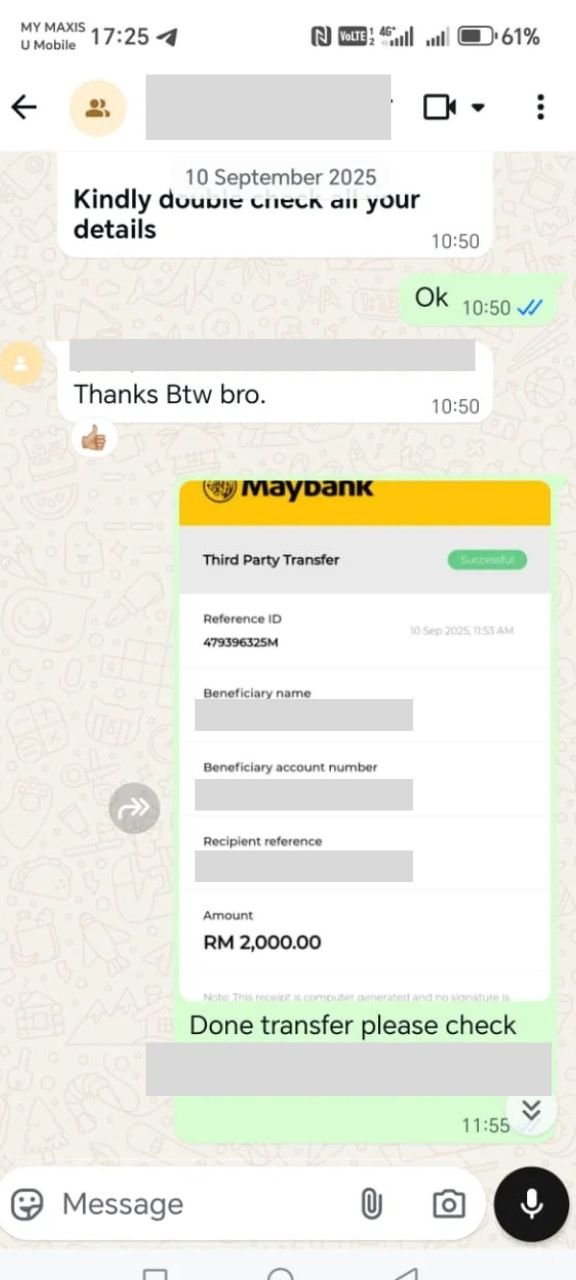

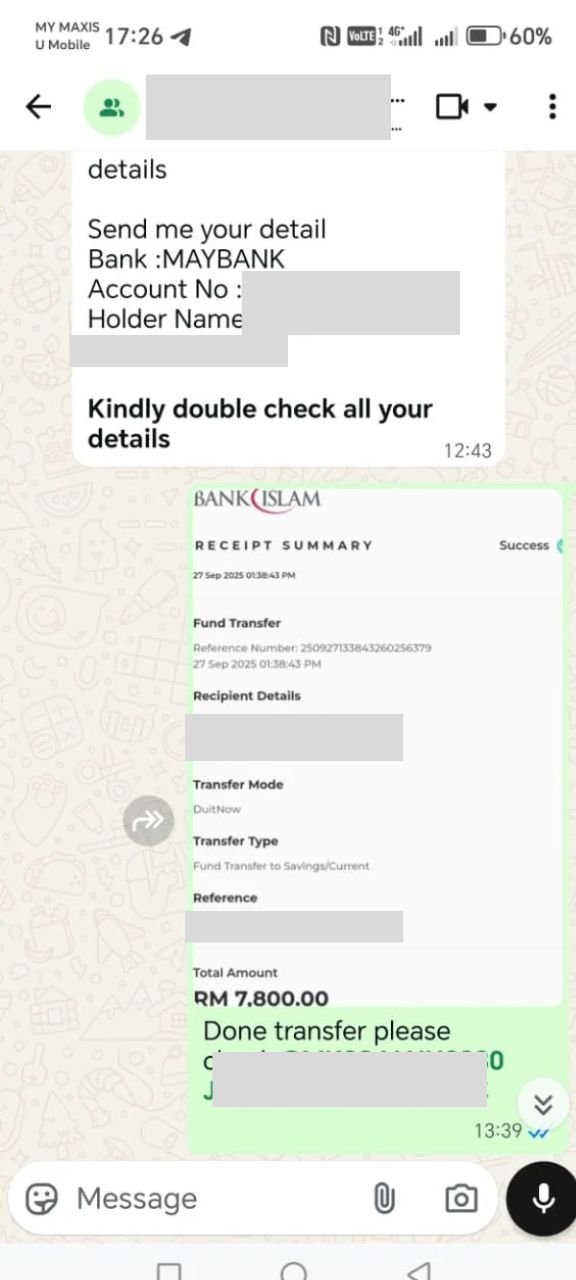

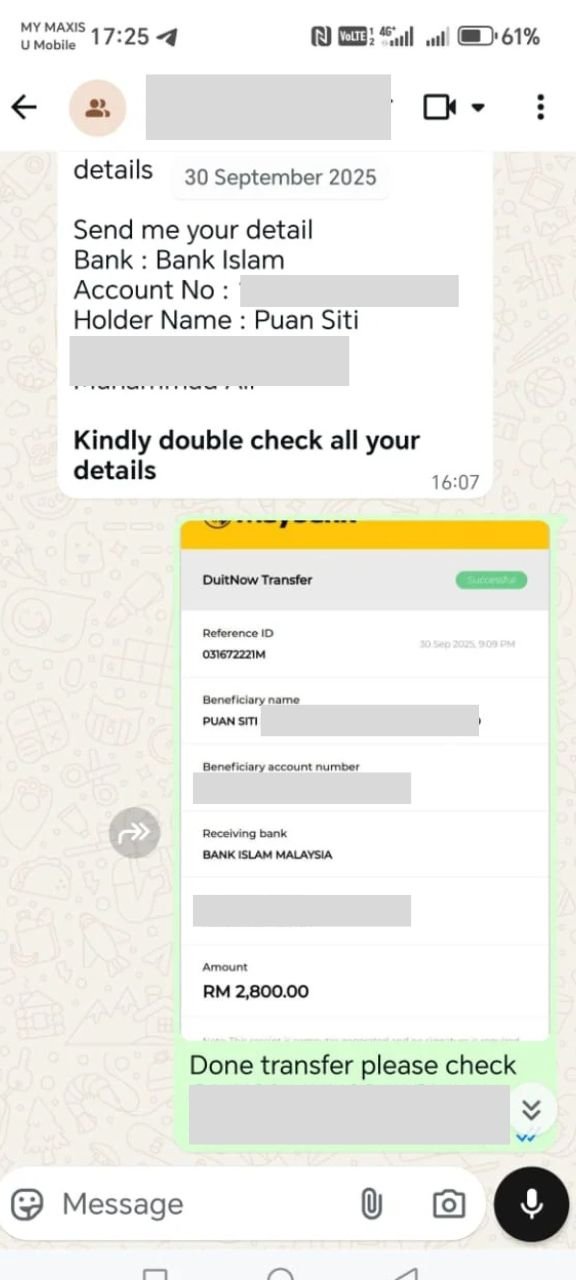

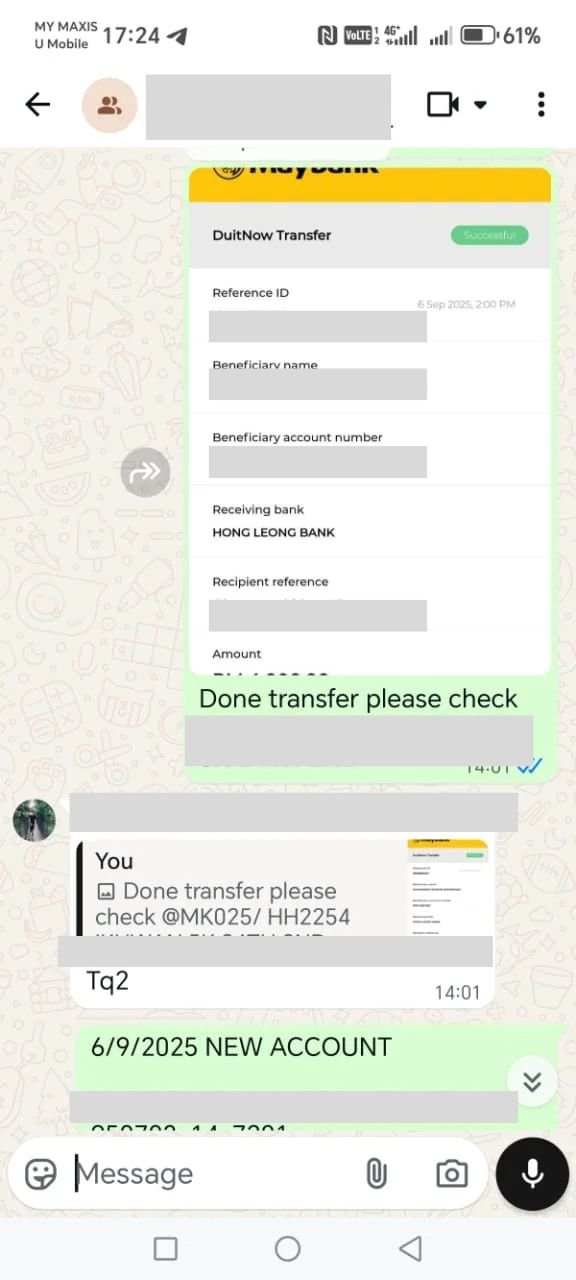

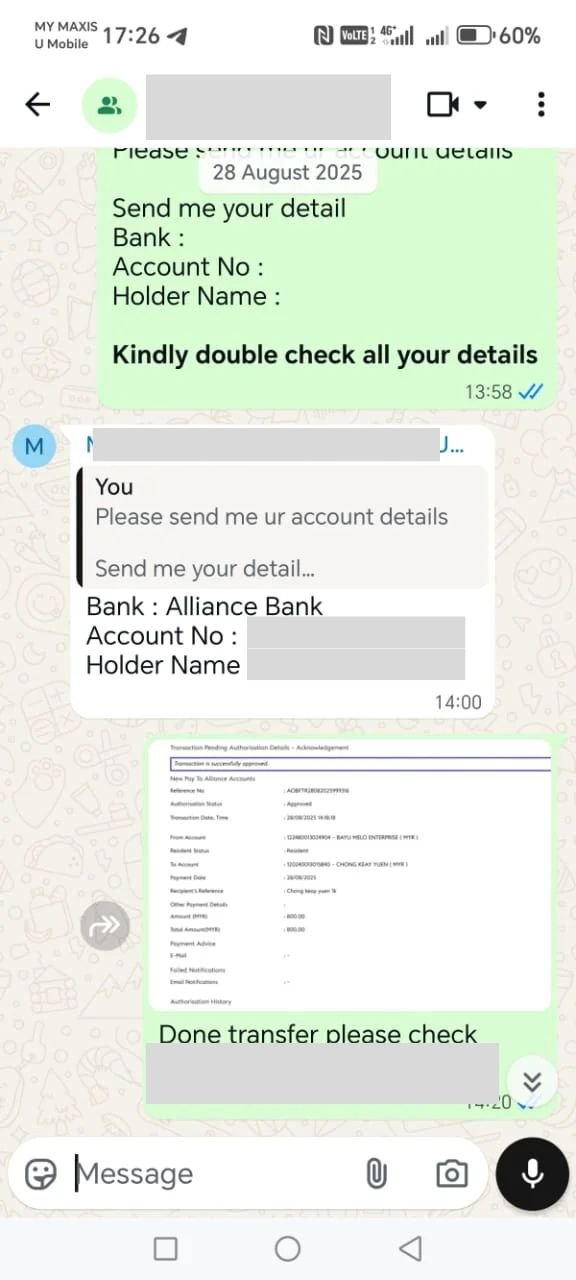

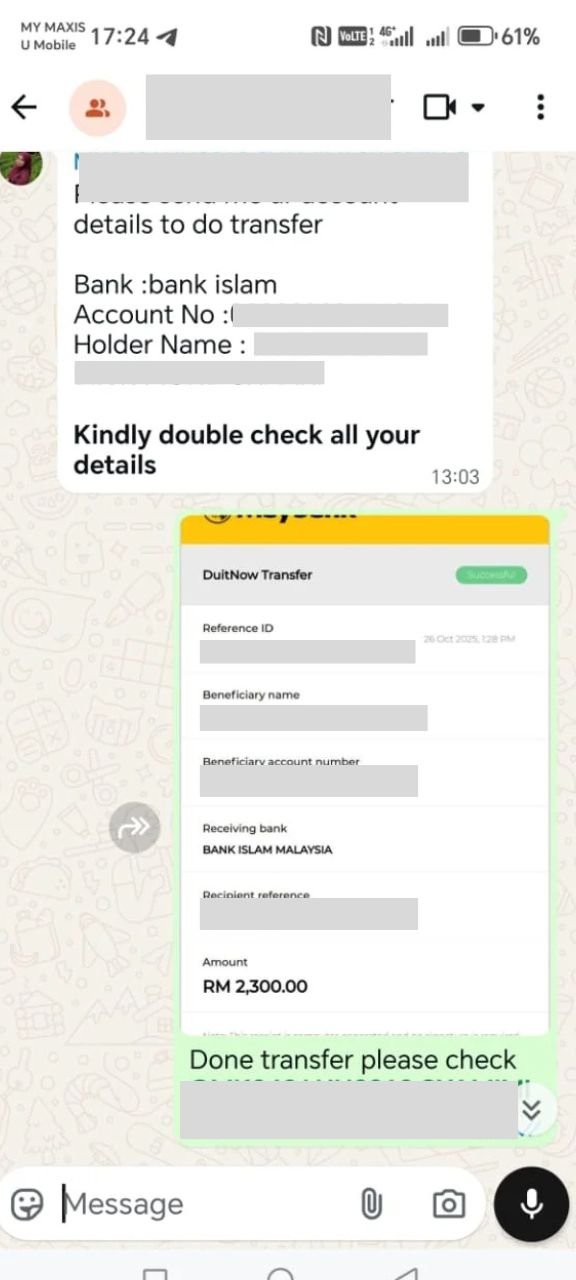

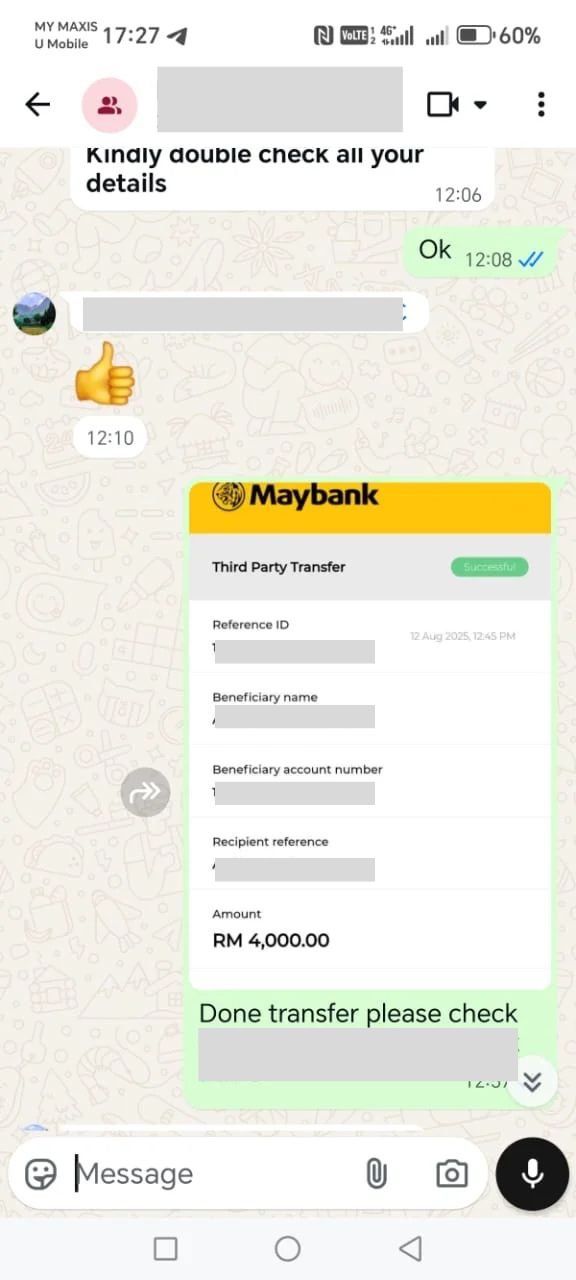

Testimonials

Proceed Only If You Meet These Conditions:

✔ Salary RM2,000+

✔ Able to provide payslip & IC

✔ Understand interest is higher than bank loans

If all conditions are met, our team can professionally review your case.

Need Cash Fast? Apply Now in Just 3 Minutes!

Get Your FREE Instant Quote

Fill in the form and get approved within 24 hours.

- License No.WL7819/10/01 – 2/200725

- License validation1/3/2024 – 1/3/2025

- Permit No.WL7819/10/01 – 2/200725